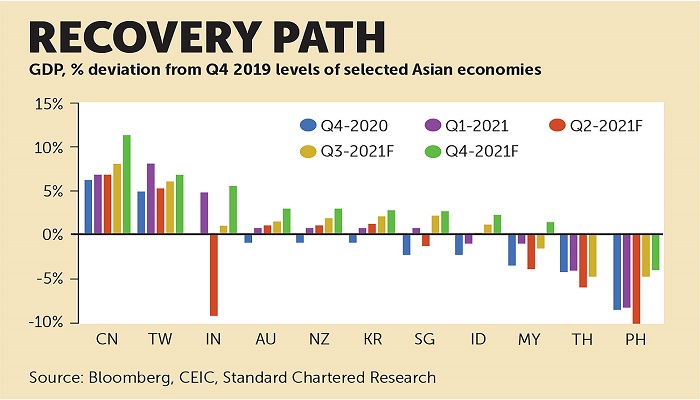

Asia of Standard Chartered CEO Benjamin Hung said ASEAN has gone through a difficult period, especially in the second and third quarters of this year as countries imposed new Covid lockdowns, disrupting manufacturing and supply chains. Hung pointed out that despite the impact of COVID, ASEAN’s share in global FDI increased from 12% in 2019 to 14% last year. “It is a model of how the world sees ASEAN as a future and a possibility.

ASEAN continues to be one of the major revenue contributors to the Bank in Asia. “Increasing intra-regional connectivity through integration of supply chains along with capital flows, integration of production networks will help strengthen ASEAN’s role in global supply chain transformation,” he said.

For example, Indonesia is seeing strong interest from Standard Chartered customers in renewable energy projects and other projects related to the transition to net-zero carbon emissions. The bank has partnered with Indonesia’s PMSE to co-finance the 145-MW Sirata Floating Solar Photovoltaic Power Project in West Java. The largest of its kind in Southeast Asia, the Cerata is set to begin commercial operation in the fourth quarter of 2021, providing enough electricity to power 50,000 homes, offset 214,000 tonnes of CO2 emissions, and Creates 800 jobs. Many of our customers, from different corridors like US-ASEAN, Europe-ASEAN, China-ASEAN, Intra-ASEAN, are most eager to reach out to ASEAN on the back of various free trade agreements and trade treaties. is being formalised,” Mr. Hung told Asia Focus. He added that the Comprehensive and Progressive Agreement for the Trans-Pacific Partnership (CPTPP) will continue to be beneficial to trade along the participating corridors. Such multilateral partnerships It is also expected to provide complementary benefits in terms of the region’s skills and resources, which will ultimately lead to a more equitable distribution of economic growth in ASEAN.For example, electric vehicle (EV) makers will invest, produce, and generate power for their domestic markets. The auto sectors of Thailand, Indonesia, Vietnam and Malaysia can tap into the diverse but complementary comparative advantages in the auto sectors, to create jobs, skills and trade. Potential growth areas for ASEAN are life sciences, pharmaceuticals and electronics as well. Are included.

Hung also said that Thailand’s decision to resume visits to international tourists from November 1 is a “good start” because with tourism contributing 15% to Thailand’s GDP, the government is determined to support growth in 2022. Bangkok and other major destinations such as Chiang Mai, Pattaya, Hua Hin and Phetchaburi are preparing to reopen.

“In our view, the Thai economy will struggle to recover without reforms in the tourism sector,” Standard Chartered said in an October 8 research report. 15 million visitors expected next year, said the Ministry of Tourism and Sports, compared to a pre-Covid total of 40 million in 2019

I think what Thailand is doing is definitely right. That direction is clear. There is such a long period of lockdown all over the world. There is a reduction in travel demand.”

ASEAN is capable of growing at almost twice the rate of the global economy in the medium term. Mr. Hung said. “From that point of view, I think ASEAN will still be an engine of growth,” he concluded. The 10-nation region will continue to be a major recipient of global foreign direct investment (FDI) as its economies begin to recover from the prolonged coronavirus pandemic, thanks largely to consumption-led growth and an expanding middle class. According to the Financial Services Group based. In addition, the region’s economy may benefit from a reduction in tourism demand as the countries open up to international visitors.

Officials say that in order to stimulate the economy and attract more foreign investment, the sector will need to expand in areas from where it wants growth. Emerging trends are poised to fuel further growth, he said, revolving around geopolitics, the consumption power of the middle class, the rise of digitization and a focus on sustainability. But we are seeing things slowly improving and in fact many markets are accelerating,” he said at a media roundtable organized by the bank recently. “Despite the challenging period, I personally see ASEAN as a Let me look at the turning point of the critical reset and there are some key trends that will be beneficial for ASEAN during the next five to 10 years.